Estate Planning.

Simplified.

Estgro empowers you to provide comprehensive generational wealth planning without needing any specialist estate planning training or expertise. Let Estgro handle the complex data analysis and deliver personalised recommendations to maximise your clients’ wealth for future generations, allowing you to focus on what truly matters—delivering exceptional service to your clients.

How it works…

STEP 1

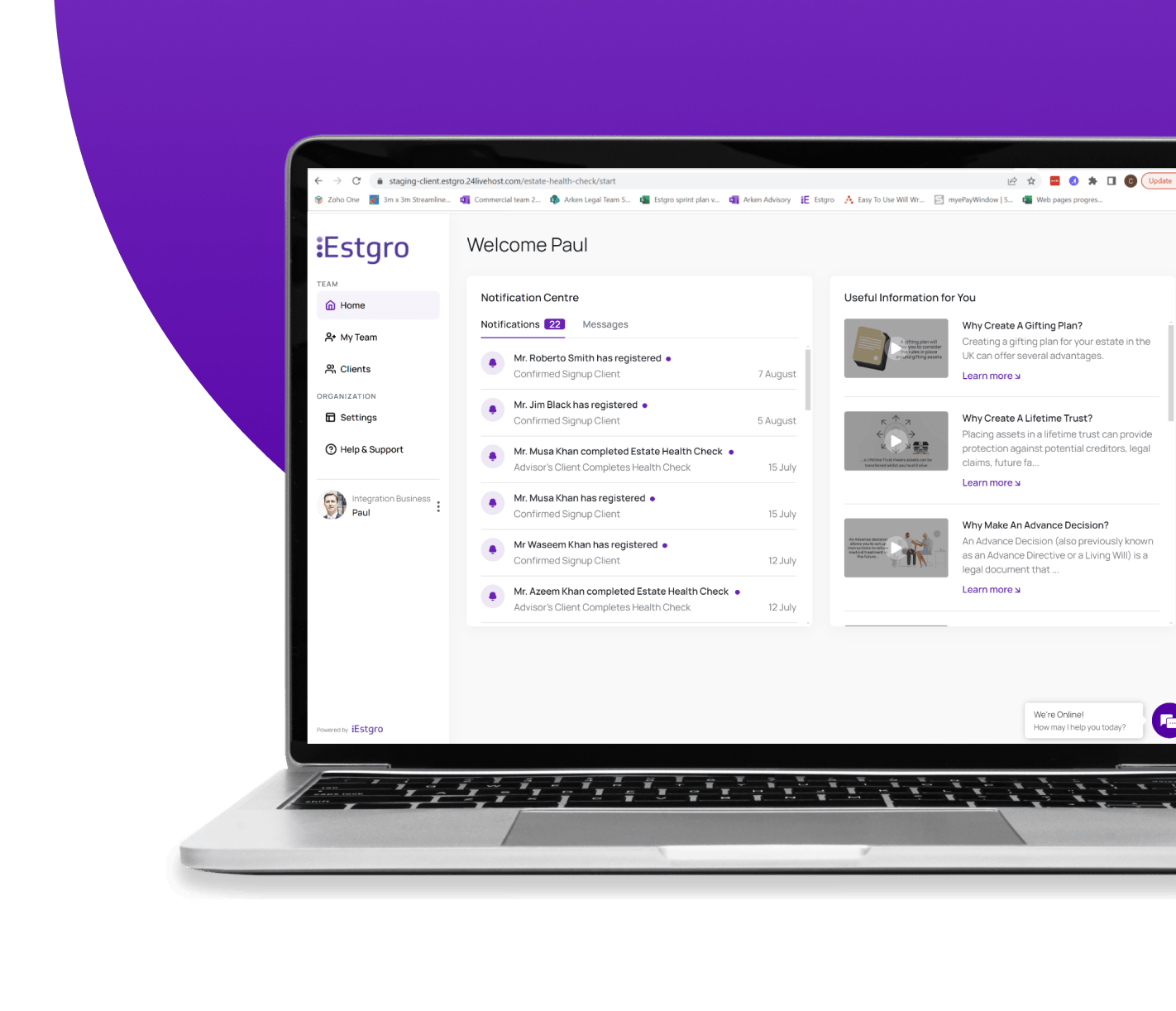

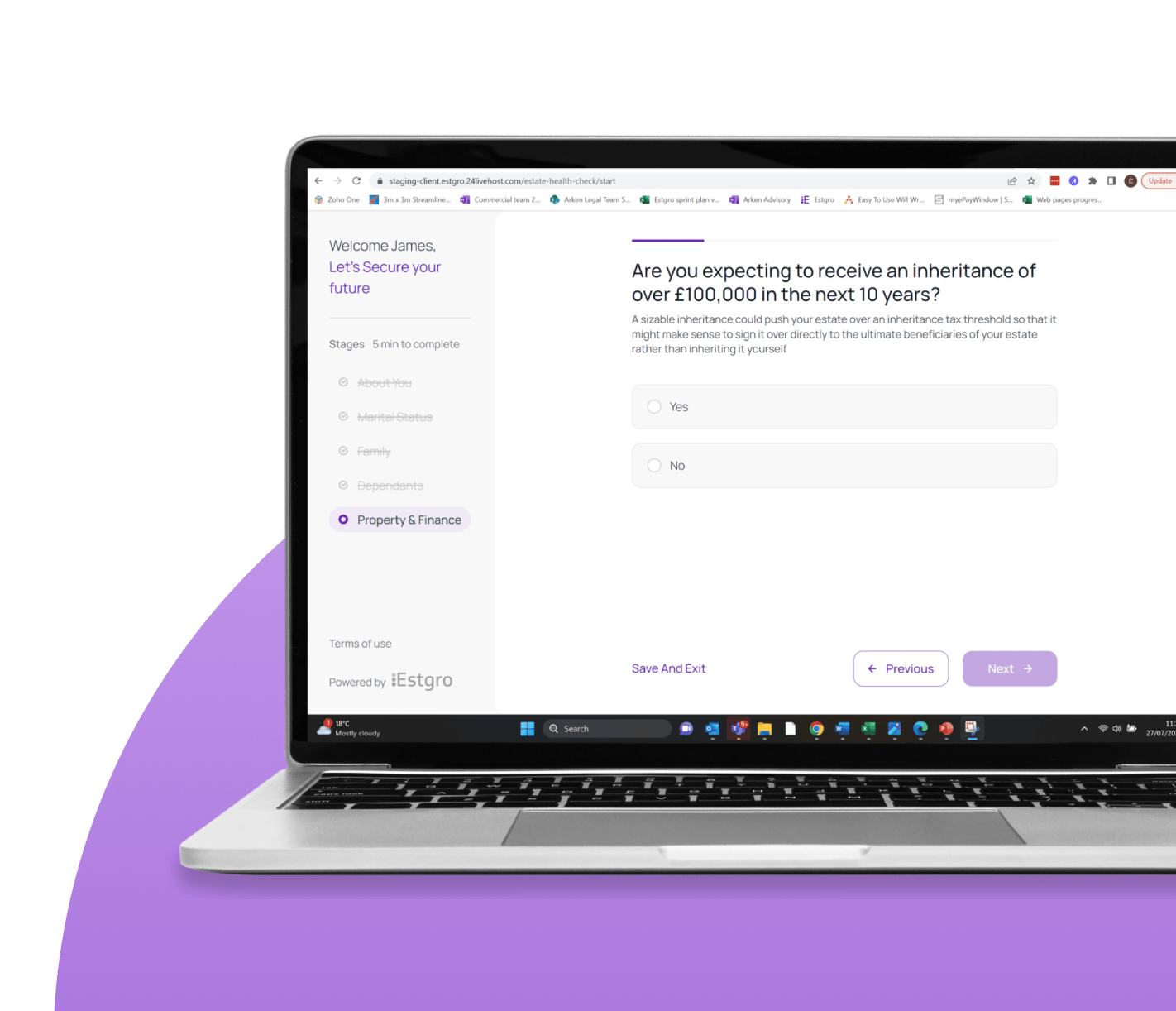

Assess

Start securing your client’s estate by pulling in data from intelliflo and enriching it with the Estgro Estate Health Check—a comprehensive assessment that captures detailed family and estate information. For non-intelliflo users, the health check also serves as a powerful standalone tool.

STEP 2

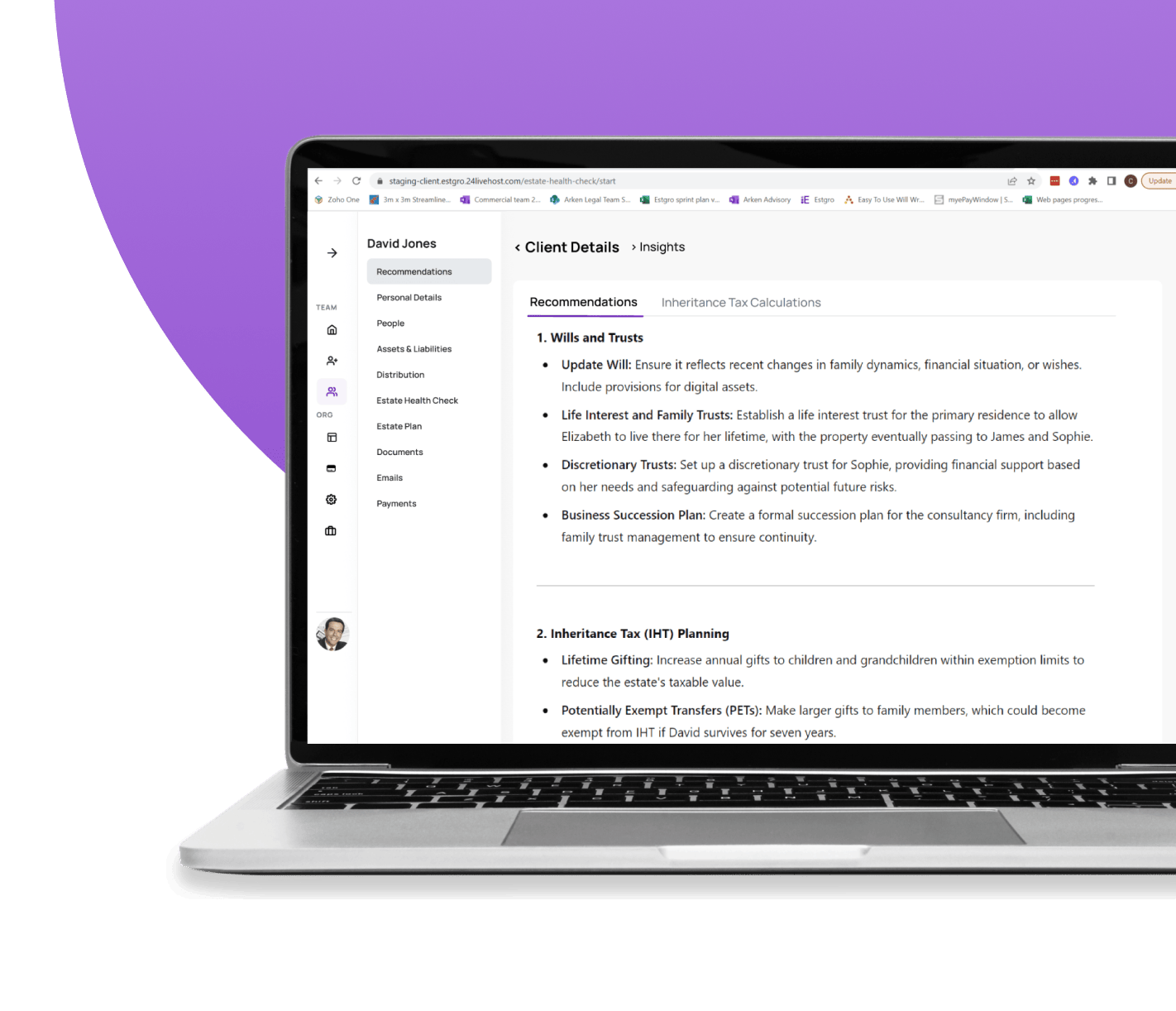

Inform

Analysing the wealth of data generated is where Estgro comes into its own. Personalised alerts and recommendations inform the adviser of the best course of action required to maximise a client’s estate, ensuring the efficient transfer of family wealth.

Recommendations include inheritance tax mitigation, Trust guidance, property protection considerations and adequate provisioning for dependants.

STEP 3

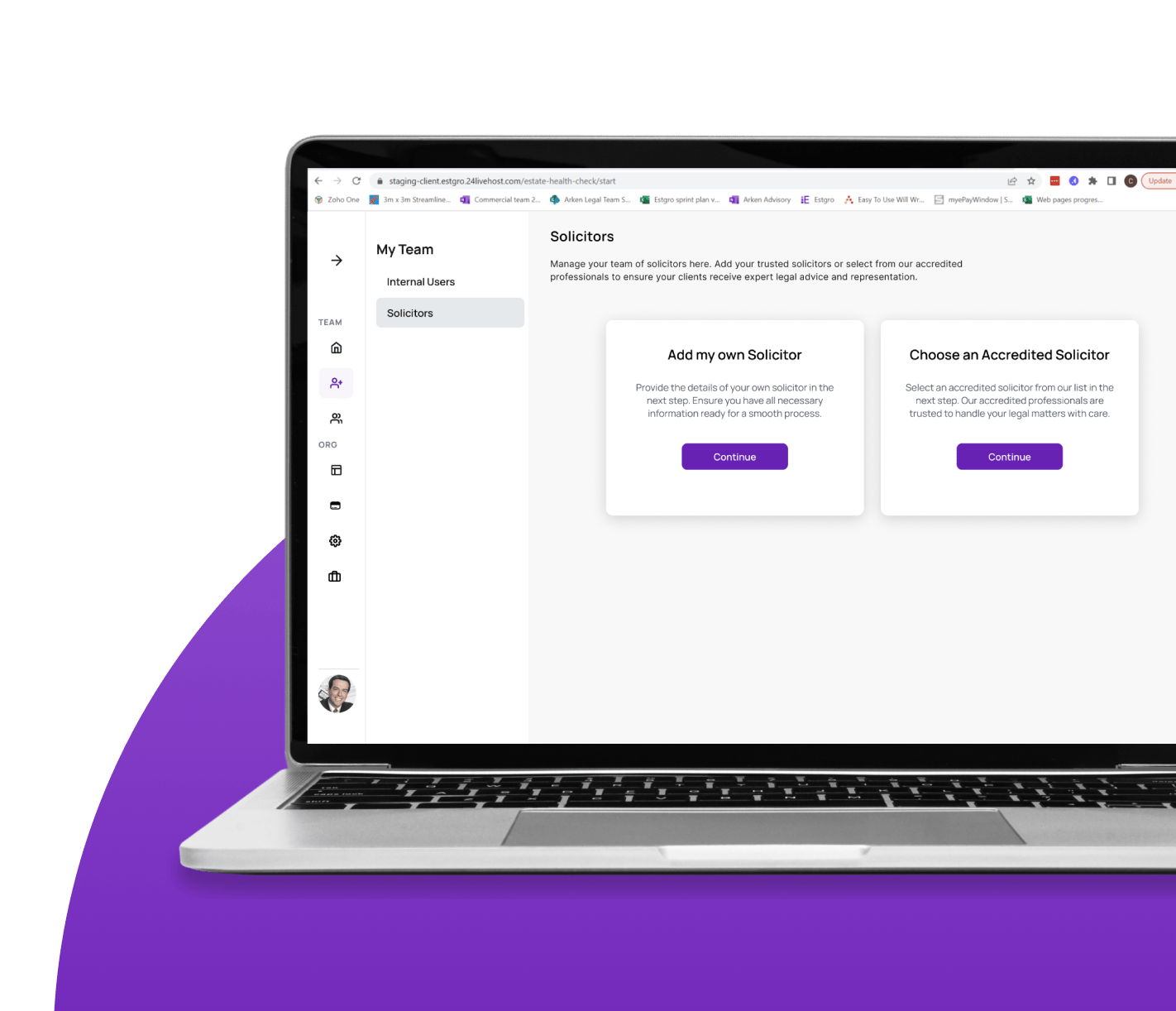

Deliver

Now it’s time to implement the recommended strategies to secure your client’s estate

Use the portal to engage with your own trusted solicitor or choose one of Estgro’s accredited partners to digitally refer, transparently track, and securely deliver all vital estate planning documentation—ensuring the on-going protection of funds under management.

STEP 4

Engage

Estgro enables advisers to connect and engage with future beneficiaries – helping to protect portfolios and safeguard funds under management.